Posted on

August 19, 2025

by

Eugene Palermo

The Toronto and Region residential resale market is currently bifurcated, with distinct trends emerging in both the City of Toronto and the 905 Region. Within the City of Toronto, there is further differentiation between condominium apartments and ground-level property sales. Overall, sales are slow across all property categories, not due to lack of demand, but due to a combination of affordability challenges and the fear and economic uncertainty triggered by the tariffs imposed by the U.S. administration.

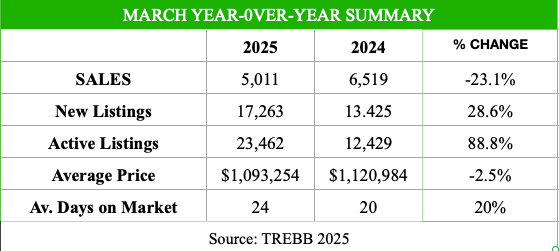

In March, only 5,011 properties were reported sold, a 23 percent decrease compared to the 6,519 properties sold in March of last year. However, it is encouraging to note that March’s sales were 24 percent higher than the 4,019 residential sales reported in February.

The decline in sales was more pronounced in the 905 Region than in the City of Toronto. On average, sales of detached, semi-detached, and townhouse properties in the 905 Region dropped by 25 percent compared to last March, while similar property types in the City of Toronto declined by just 12.6 percent. The 905 Region accounts for approximately 62 percent of all reported sales. The average sale price for the Toronto and Region resale market decreased by 2.5. percent in March, from $1,120,984 last year to $1,093,254 this year. This average sale price, however, does not reflect a homogeneous market.

As in the case of sales, average sale prices are similarly bifurcated. The average sale price for detached, semi- detached, and townhouse properties sold in March dropped by 5 percent compared to March 2024. However, similar housing types in the City of Toronto saw a 1.3 percent increase in average sale prices. Given that there were 3,539 combined sales of detached, semi-detached, and townhouse properties in the 905 Region, compared to only 962 in the City of Toronto, the declines in average sale prices and sales are disproportionately reflected in the overall sales and average sale prices for the Toronto and Region market.

Notwithstanding their lofty prices, detached and semi-detached properties in the City of Toronto sold quickly and, in most cases, above their asking prices. In March, the average sale price for a detached property was $1,337,498, 5 percent higher than in February and 2.6 percent higher than in March of last year. On average, all semi-detached properties sold for 107 percent of their asking price, and in only 15 days. In Toronto’s eastern districts, all semi-detached properties sold in just 13 days and, given the overall market, for an impressive 111 percent above their asking price.

The condominium apartment resale market, however, continued to decline in March, in stark contrast to the performance of detached and semi-detached properties. Most condominium apartments are located in the City of Toronto, with the central core of Toronto accounting for 70 percent of these listings. As of the end of March, there were 4,681 active condominium apartment listings, which represents 35 percent of all active listings in the Toronto Region. Therefore, condominium apartment listings have a large and disproportionate influence on the overall market, particularly regarding price and sales. In March, 1,404 condominium apartments were sold, nearly 30 percent of the total sales reported for the month. The average sale price for all condominium apartments was $682,019, nearly 2 percent lower than last year. Condominium apartments sold for only 98 percent of their asking price, and on average, after 32 days on the market—33 percent longer than the overall market and almost 80 percent longer than detached and semi-detached properties. The average sale price for condominium apartments in the City of Toronto was slightly higher at $716,460.

Indeed, this market is deeply bifurcated. The Toronto and Region residential resale market has been negatively impacted by the constantly changing policies of the Trump administration, which, like other global markets, has created uncertainty. Real estate markets generally prefer stability. In early April, the Trump administration formalized its tariff policy, and it is clear that Canada—especially southern Ontario—will be affected. Job losses and a downturn in the economy are expected, which will likely prompt the Bank of Canada to lower its overnight lending rate, potentially making homeownership more affordable.

The residential resale market could experience a situation similar to the Covid-19 environment, though driven by different, but equally powerful, factors.