It is hard to believe that in a span of fifteen months the Toronto and region real estate resale market has gone from record breaking sales and house prices to a precipitous decline, not seen in decades, to a market resurrection in May. Although May did not match the dizzying highs of February and March of 2022, resale results were nothing short of impressive.

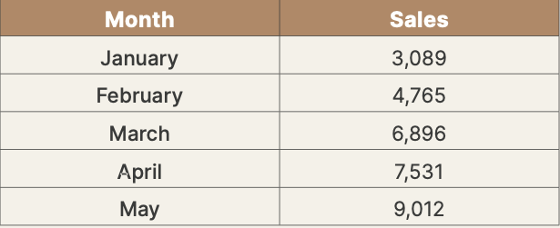

May marked the forth consecutive month of rising sales. What was particularly impressive was the increase in the number of reported sales compared to April. The market reported 9,012 sales in May, a 20 percent increase compared the 7,531 achieved in April, and a 25 percent increase compared to the 7,226 reported sales in May 2022. Whether this accelerated pace can continue into June will depend on a number of factors that will unfold during the course of the months to come.

Clearly the demand for ownership in the greater Toronto region remains strong. Satisfying it continues to be a problem. Government at all levels have simply failed to provide the necessary housing that the region’s high levels of immigration have necessitated. What new housing that has been provided has become even more expensive due to excessive regulatory barriers. A recent C.D. Howe study estimates that in Toronto new homes are $350,000 more expensive due to the regulatory burdens that are choking the housing supply.

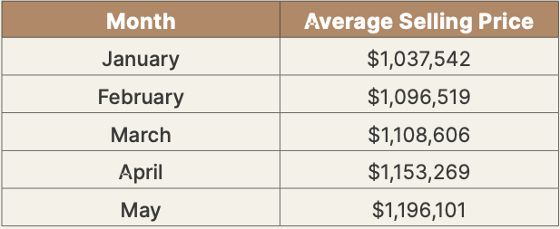

It is no surprise that for the forth connectivity month the average sale price for all properties sold in the Toronto region once again increased, which includes condominium apartments which formed almost 30 percent of the 9,012 reported sales.

The average sale price of condominium apartments was only $748,483 across the region. Detached properties came in at $1,556,566 (but $1,913,132 in the City of Toronto) and the average sale price of semi-detached properties was $1,198,185 (and $1,398,821 in the City of Toronto). What these numbers demonstrate is that the exodus to regions outside the City of Toronto that took place during the pandemic appears to have reversed. During the pandemic demand in the 905 region caused average sale prices in the region to rival Toronto prices. Since January prices throughout the combined City of Toronto-416 region have increased by more than 15 percent.

Demand and supply are having a major impact on average sale prices. In May 15,194 new properties came to market. This was almost 20 percent fewer properties than came to market last May (18,687). As a result of the fewer properties coming to market and the high number of sales that were achieved in May, beginning in June there were merely 11,868 properties available to buyers, substantially lower than the 10 year average for available listings for the month of May.

Given the shortage of available properties on the market it is not surprising that months of inventory for the region has dropped to 2.2 months and that all sales (on average) took place at 105 percent of their asking price. And these sales took place in only 14 days! Even though the average sale price of detached properties came in at almost $2,000,000 in the City of Toronto, all sales took place in 13 days and at 105 percent of their asking price. Semi- detached properties, which had an average sale price of almost $1,400,000, all sold in a mere 11 days and at 111 percent of their asking price. Semi-detached properties in Toronto’s eastern districts all sold in an eye-popping 7 days and at an astounding 118 percent of their asking price. These are truly incredible market statistics and speak to a market very reminiscent to that at the height of the pandemic market, a phenomenon that only a few months ago we thought would be a historical phenomenon never to be repeated.

The supply issue is of particular concern in Toronto’s detached and semi-detached property sectors. At the end of May there were 1,286 active detached listings in Toronto. In May 970 detached properties were reported sold. At the end of May there were only 261 active semi-detached listings in the City of

Toronto, fewer than the 285 that sold in May. These numbers point to a crisis in supply.

Early June results are indicating that the resale market may be plateauing. This is due to three factors. The lack of supply, particularly in the detached and semi-detached housing sector, the average sale price hovering at $1,200,000, and high mortgage interest rates coupled with the added stress test, combined are making buying a home in the City of Toronto and the surrounding region prohibitive. The threat of a potential benchmark rate hike by the Bank of Canada is also causing apprehension amongst buyers. June’s results will be telling as to the direction of the residential resale market for the second half of 2023.

Comments:

Post Your Comment: