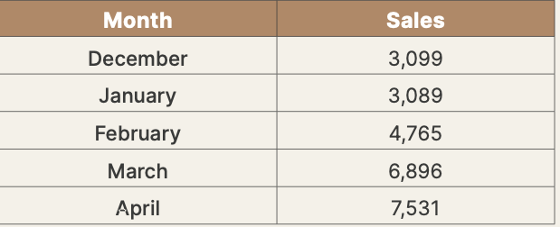

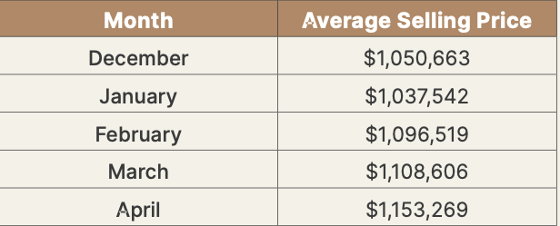

March produced the first year-over-year negative variance in 2024. Both January and February saw positive variances. In March 6,560 residential properties of all types were reported sold in the greater Toronto region. Last March 6,868 homes were reported sold, a 4.5 percent decline. This negative variance is misleading and does not accurately reflect how robustly the resale market is performing.

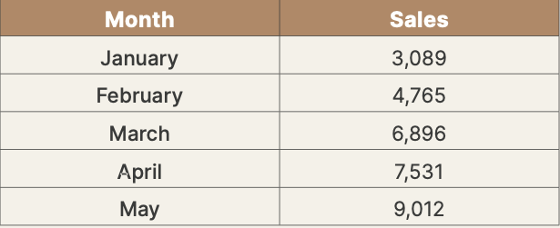

During the first quarter of 2023 the Bank of Canada’s benchmark rate stood at 4.50 percent. Even though it had gradually risen to that number throughout 2022, buyers and sellers had adjusted to the new rate reality, and as a result, the sale of homes in the Toronto region was moving along at a very brisk pace. Too brisk for the Bank of Canada. In June the Bank of Canada once again increased its benchmark rate, this time to 4.75 percent and did so again by another 0.25 percent in July, effectively killing the resale market. The second half of 2023 saw a steady decline in monthly sales, from a high 8,961 in May, before the Bank of Canada began to tighten its monetary policy, to a low of 3,423 reported resales in December.

The higher rates did not come into effect until the summer of 2023. Consequently, reported sales were strong until that time. Sales for March of 2024, although fewer than were reported last March, are actually still strong, beginning to approach historical averages for the month. This happened in the face of the Bank’s 5.0 percent benchmark rate. Once again buyers have adjusted to the prevailing cost of financing and as the resale data in March’s sales activity indicates have re- entered the market in droves. So, as we move through 2024 we should see increased sales every month, particularly if the Bank of Canada begins to reduce its benchmark rate, as is anticipated.

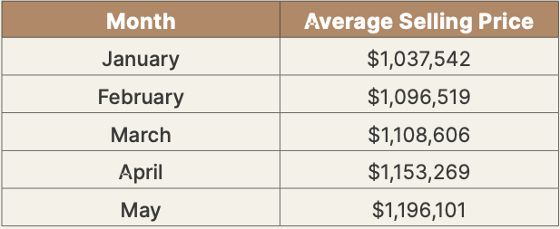

If we extract condominium apartment sales from the market mix the numbers are even more impressive. Detached property sales that sold at an average sale price of $1,308,000 ($1,400,000 in the City of Toronto) sold at 102 percent of their asking price (103 percent in the City of Toronto) in only 17 days. Semi-detached property sales in the region – the sweet spot in the resale market – sold at 107 percent of their asking price (110 percent in the City of Toronto) in an astounding 12 days. In the City of Toronto’s eastern neighbourhoods semi-detached properties sold at 116 percent of their asking price and in only 11 days!

These numbers give rise to two questions. Firstly, if detached and semi-detached properties sold so quickly and above their asking price, why did we not see more sales, and a positive market variance? And secondly, why are condominium apartments, the least expensive housing type available to buyers, not doing well.

Given their price point you would think that condominium apartment sales would do better than the rest of the market? The answer to both questions is the same. Affordability – or lack thereof.

In March the average sale price for all properties sold came in at $1,121,615, 1.3 percent higher than the average sale price of $1,107,018 achieved last March. High average sale prices combined with five-year mortgage interest rates of more than 5 percent, not to mention the mortgage stress tests which add another two percent to buyers’ qualifying ability, take Toronto region properties beyond the affordability capabilities of most buyers. There is voluminous engagement in the market – as the high percentage of sales over asking prices and days on market demonstrate – however most of the buyers in the market are constrained by their household income as it compares to average sale prices.

This problem is even more pronounced for first time buyers who most often are condominium apartment buyers. Even though condominium apartments are the least expensive housing type, the cohort of first-time buyers are, for the most part, buyers with the smallesthousehold incomes. Consequently, in the City of Toronto, where 65 percent of available condominium apartments are located, sales were down by 15.5 percent compared to March 2023, and the average sale price dropped, albeit marginally, to $729,392.

Although supply is increasing it is not doing so at a pace that will dramatically impact the prevailing market dynamics. In March, 13,120 new properties of all types came to market, 15.1 percent more than the 11,394 properties that came to market last year. At the end of March there were only 12,459 homes available to buyers, although higher than last year, still exceptionally low by historical patterns.

Looking ahead to April and the second quarter of 2024 we can anticipate a similar performance to what occurred in March. Sales will continue to increase, but real growth will be constrained by affordability and supply – 47 percent of all available properties at the end of March were condominium apartments, and unfortunately, for the reasons discussed above, the least robust sector of the overall market.

.jpeg?cc=1714490764872)