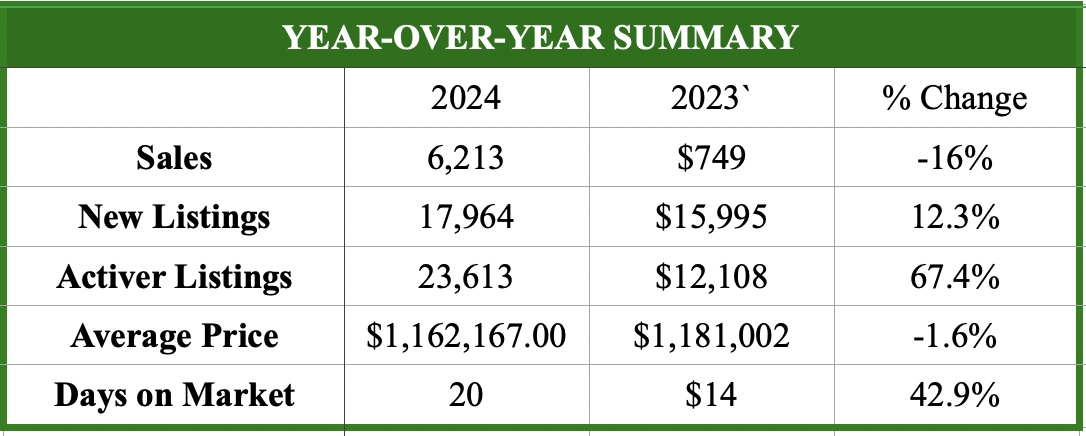

2024 was not quite the annus horribilis that the real estate resale market experienced in 2023, but it was still an extremely challenging year, with year-end results marginally better than the previous year. In 2023, the Toronto Regional Real Estate Board reported 65,877 properties sold. By year-end, approximately 68,500 homes will have changed hands, a modest 4 percent improvement.

These numbers can only be appreciated when viewed from a historical perspective. Throughout the decade leading up to the COVID-19 pandemic annual sales averaged over 90,000 properties, with 113,040 sales in 2016. The highest number of sales ever recorded was 121,712 in 2021 during the height of the pandemic. Sales in 2024 are, sadly, consistent with those recorded in the late 90s. For example, in 1997, 69,530 properties traded hands.

2024 was an uneven year. It was historically slow for the first nine months. In its fight to tame pandemic driven inflation, the Bank of Canada had, by July, increased its overnight lending rate to 5.00 percent, a rate not seen in decades. Bond rates also increased, resulting in fixed-term, five-year mortgage interest rates approaching 6.00 percent.

Unlike previous real estate recessions, there was no decline in the average sale price for all properties sold. In 2023, the average sale price came in at $1,126,266. This year, it will come in at around $1,120,000, a marginal difference. Condominium apartment sales were the weakest, and condominium apartment sale prices lost ground throughout the year, unlike ground-level homes—detached, semi-detached, and townhouses—which strengthened throughout the year. Detached and semi-detached property sale prices averaged approximately $1,265,000 throughout the Greater Toronto Area, and almost $1,500,000 in the City of Toronto.

During real estate recessions, sale prices typically decline. The period between 1990 and 1996 is the most recent example when house prices declined by more than 25 percent. This did not happen in 2024. Firstly, demand has remained strong. Massive population growth over the last few years has resulted in a supply shortage. Secondly, most homeowners enjoyed mortgages with incredibly low rates, unlike the 90s, allowing them to hold their prices until an acceptable offer was presented by a buyer. Although multiple offers declined in 2024, it was not unusual to see bidding wars for desirable properties in sought-after neighborhoods, particularly semi-detached properties in the $1,250,000 price range.

In July, the Bank of Canada made its first rate cut, a modest 0.25 percent, but it was the beginning of more cuts to come. By year-end, the Bank had made six more cuts, bringing the overnight rate to 3.25 percent. With these rate cuts came an improved resale market: mortgage interest rates declined, allowing buyers who had been marginalized by high mortgage rates to re-enter the market. By the end of 2024, year-over-year sales for the last few months of the year were up by more than 40 percent. 2024 is clearly closing on a positive note.

It should be noted that there were major industry changes in 2024. The provincial government implemented Phase II of its regulatory changes, designed to achieve more industry transparency. The legislation came into affect in December 2023 but its effects were not experienced until this year. Buyer and seller representation became more transparent, a concept called “self-represented party” was introduced, a mandatory consumer information guide became available, and perhaps the most dramatic change—the content of offers could be shared with competing buyers by sellers (open bidding). The latter change was in response to the blind-bidding frenzy that was prominent during the pandemic, and the belief that it drove up average sale prices. A year after sharing the content of offers became legal, it has been rarely used. No doubt, market conditions are partially responsible for the lack of uptake in sharing content, but overall consumer (seller) reluctance has been primarily responsible. Unexpectedly and perhaps counterintuitively, buyer resistance to open bidding has been as forceful as that of sellers. This consumer response, both by sellers and buyers, is not likely to change going forward. Phase III changes are expected in 2025.

The Real Estate community is not sad to see 2024 come to an end. It was another challenging year, with wide swings in the Bank of Canada’s overnight rate and legislative changes that have, to some degree, altered the real estate sales landscape. As the year ends, it is comforting to note that the industry has met these challenges and is moving positively and optimistically into 2025. On a year-over-year basis the last few months were the most robust in 2024 pointing to growth in sales in 2025.

Prepared by: Chris Kapches, LLB, President and CEO, Broker

.jpeg?cc=1714490764872)