The Bank of Canada, as anticipated, reduced its benchmark rate in June, but it did not have the desired market effect. In fact it had the opposite effect. That’s because the rate cut was marginal, only 0.25 percent, not enough to move the resale market needle. Mortgage markets and bond markets had already analyzed and digested the prevailing economic data and had already priced into the Bank of Canada’s rate cut. Except for variable rates, still very lofty at 6.4 percent, there was no movement in fixed five year terms. After the Bank of Canada’s rate cuts, five year fixed term rates remain above 5 percent.

Since the Bank’s rate cut had no impact on fixed mortgage rates, affordability was not affected. Buyers were immobilized by this insignificant rate cut, now hoping for a better financing environment after the Bank meets again in late July.

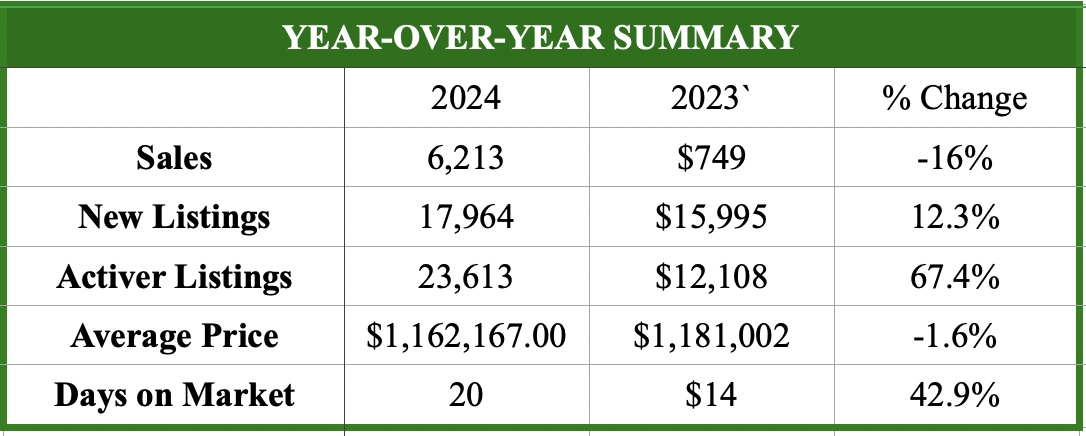

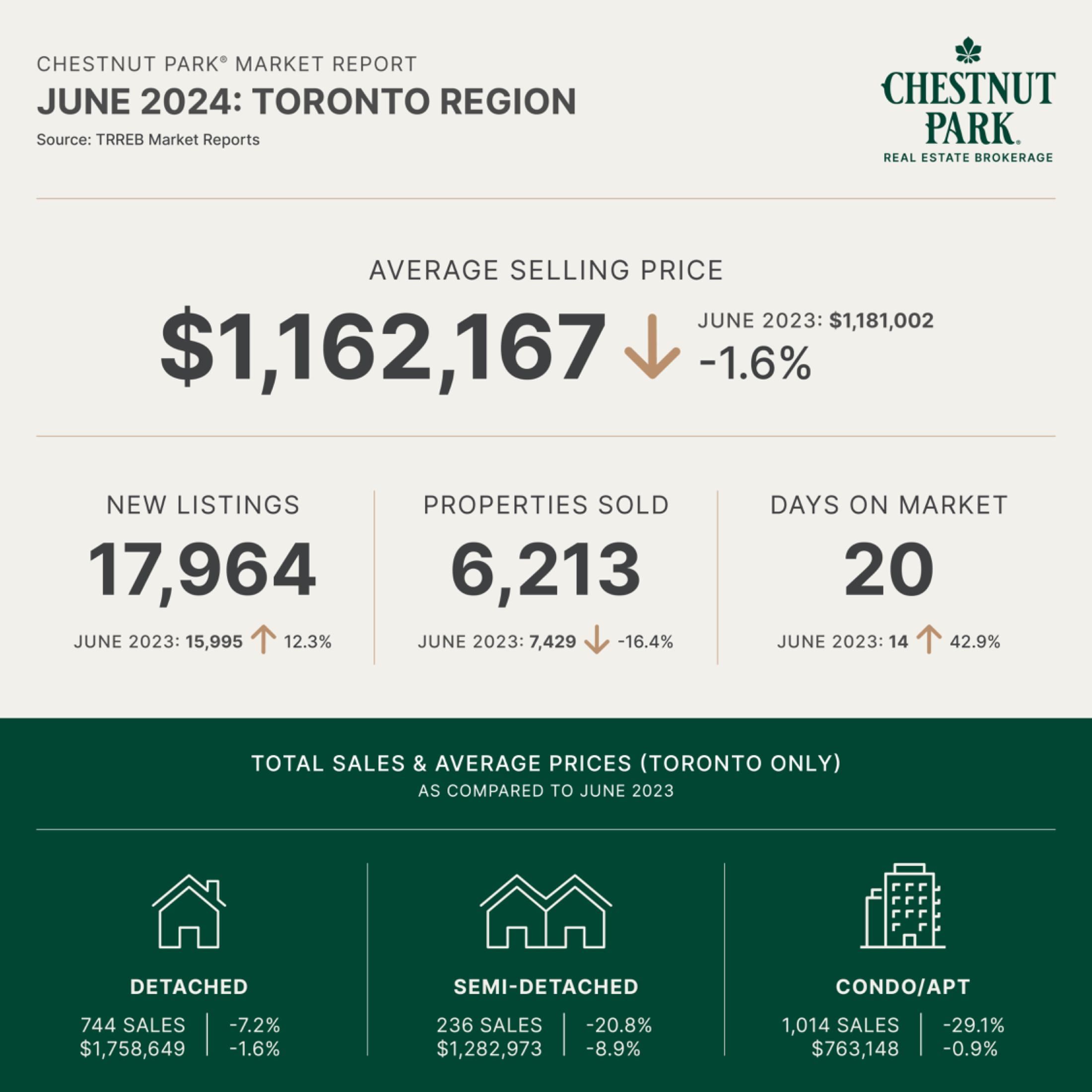

Sales for the City of Toronto and the surrounding Region totalled 6,213 properties in June, 16.4 percent fewer than the 7,429 sales that were reported last year. The decline in sales was universal, affecting all housing types throughout the entire Region. Condominium apartments, the most financially sensitive housing type, dramatically demonstrated the affordability crisis. Condominium apartment sales declined by over 28 percent, notwithstanding that they are the least expensive housing type. The average sale price of condominium apartment sales came in at $727,861. Condominium apartment sales represented almost 50 percent of the overall Toronto and Region resale market, a huge drag on the monthly numbers.

Notwithstanding the decline in sales the average sale price for all properties sold, including condominium apartments has remained very resident.

In June, the average sale price came in at $1,162,167, marginally lower than it was last year. Even though affordability has plagued the resale market throughout 2024 (and the later half of 2023) the average sale price has continued to rise throughout the year. In January, the average sale price was only $1,025,262. It has increased by more than 13 percent since the beginning of the year.

Inventory has also increased throughout the first half of 2024. At the end of June there were 23,613 properties available to buyers, 67.4 percent more than the 14,108 available last year. This volume is now beginning to push beyond pre-pandemic inventory levels. At the same period, in 2018 and 2019, inventory levels were approximately 20,000. At the end of June there were 8,806 condominium apartment available to buyers. Almost 40 percent of the total available inventory is represented by condominium apartments.

Although sales and average sale prices of detached and semi-detached properties declined, the properties that sold did so in robust fashion. All detached properties in the City of Toronto sold in only 15 days and at 101 percent of their asking price. The average sale price for all detached properties sold came in at $1,758,649. All semi-detached properties sold in only 13 days and, amazingly, for 105 percent of their asking price. In Toronto’s eastern trading districts, all semi-detached properties sold in only 10 days on market and for an eye-popping 110 percent of their asking price. The average sale price for semi-detached properties in June came in at $1,282,000.

At first glance, it is difficult to reconcile the performance of detached and semi-detached properties against the backdrop of declining sales numbers. A deeper analysis indicates that demand, primarily due to population growth, remains strong. The problem is that most buyers can not afford to purchase detached and semi-detached properties with five year interest rates at more than 5 percent. In addition, there is the hurdle of the crippling mortgage stress test amounting to another 2 percentage points. Those that could afford the lofty detached and semi-detached properties aggressively bought them, and in almost record time, paying over the asking prices.

Condominium apartment sales are the weakest sector in the resale market. Inventory levels have increased substantially, approaching almost 9,000 units, as fewer apartments are absorbed by sales. At the end of June there are almost 9 months of condominium apartment inventory in the Toronto and Region resale market. Surprisingly the average sale price in Toronto’s central core for condominium apartments came in at $815,305. This is no doubt due to the fact that out of the 1,014 reported sales 20 of these apartments sold for prices between $1,750,000 to $2,000,000.

So what can the resale market anticipate for July? In a phrase, more of what happened in June. The central force is affordability, or a lack thereof. That will not change in July, although it might in August. The next Bank of Canada scheduled date for announcing its overnight target date is July 24th. It is anticipated that the Bank will once again reduce its overnight target by another 0.25 percent. This will result in five year mortgage interest rates coming down to around 5 percent. That will probably not be enough to significantly move the resale needle, which means that July and August (which are also seasonally slow months) will not be dissimilar to what the resale market experienced in June. A more aggressive rate cut by the Bank will stimulate the market resulting in a dramatic rise in sales.

.jpeg?cc=1714490764872)