There were no surprises in the July residential resale data provided by the Toronto Regional Real Estate Board. A post- pandemic pattern and market correction has emerged and barring any unexpected geo-political issues that might appear, the market pattern that has developed will continue through the remainder of 2025.

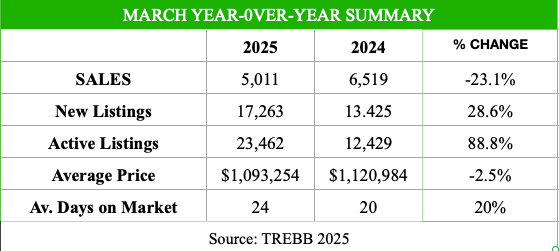

The market pattern can be characterized as follows: modest sales growth but substantially lower than the 10 year average; higher than average inventory levels; longer periods on market for properties before sale; and continual moderate decreases in average sale prices. The Regional market is a little more complex than this pattern alone, with regional differentiation and differentiation by housing type.

The Bank of Canada began its benchmark rate reductions in June of last year. In July, the Bank lowered the rate by another 0.25 percent, bringing it to 4.5 percent. Rate reductions continued throughout 2024. Rather than stimulate sales, these rate reductions had the opposite effect. Buyers, anticipating continued rate reductions, held off purchasing, anticipating and hoping for more favourable mortgage financing, which never materialized. Lower mortgage rates did not materialize because mortgage rates are driven by bond yields, not the Bank of Canada’s overnight lending rate. Bond yields remained high and continue to remain high. As a result, there has been little or no movement in mortgage interest rates. Five-year fixed term rates continue to hover around 4.5 percent. Then in January of this year the Trump administration took office and the uncertainty of Trump’s tariffs has completely unsettled real estate markets.

Given these underlying factors, the 6,100 sales achieved in July is a positive market sign. However, these sales were achieved at a result of declining average sale prices. Every housing type in the Toronto Region, some more than others, saw average sale price declines in July. Overall, the average sale price declined to $1,051,719, 5.5 percent lower than last July’s average sale price of $1,113,1161. The decline in the average sale price has improved affordability in the Region, affordability relief that has not been forth coming in the form of lower mortgage cost.

The market as a whole saw properties selling at 98 percent of their asking price and in 26 days.

The decline in average sale prices has not been homogeneous throughout the Region. Prices in the City of Toronto have not eroded to the same degree as prices in the 905 Region. In July, average sale prices for all property types in the City of Toronto declined by 4.8 percent, led by condominium apartments which declined by 8.6 percent. Prices in the 905 Region declined by 7.65 percent, also led by condominium apartments which declined by 10.3 percent year-over-year. No doubt this bifurcation is also a post-pandemic correction. During the Covid-19 market buyers sought the sanctuary of more space and more reasonably priced housing than was available in the City of Toronto. That phenomenon has reserved itself.

The decline in average sale prices is primarily driven by the large number of properties on the market available to buyers. Except for some isolated, desirable market areas, the heady days of competing offers for properties has come to an end. Buyers now have the luxury of time and choice. Time to negotiate offers that are financially acceptable, and choice to choose from the 30,215 properties listed for sale in July, not a record, but substantially more available properties than have been on the market over the last decade. It should be noted that of those 30,215 properties on the market in July, 33 percent, or 10,013 were condominium apartments, the bulk of them, 65 percent, located in the City of Toronto.

Given these market dynamics, it is not surprising that homes are taking longer to sell. The average days on market has been inching up since the beginning of the year. In July it took 30 days for all properties (on average) to sell, 6 days longer than last year. This number is not entirely accurate. More than 30 percent of all available properties have been listed more than once. Having failed to sell during the initial listing they are relisted, most often at a reduced asking price. The Board’s days on market data only recognizes the last listing for properties before sale.

Looking ahead, affordability continues to be an obstacle to homeownership for most buyers. The average sale price of $1,051,719 is not a good reflection of actual values. In the City of Toronto detached properties sold for $1,572,832. Semidetached properties sold for $1,242,388, and townhouse came in at $920,197. Condominium apartments sold on average for $684,257. Although lower overall, the ratio of sale prices for detached, semi-detached, townhouses and condominium apartments in the 905 Region was similar. Given household incomes in the Region, only condominium apartments can be regarded as “affordable”. Unfortunately, given the size of most condominium apartments that have been built over the last decade, they are not liveable by families.

The second half of 2025 will be a vast improvement over the second half of 2024. Market conditions that have defined the last few months will continue – improved sales, and moderate price reductions that will stabilize by year-end, with variations on this theme based on trading areas and housing types.