Posted on

June 21, 2023

by

Eugene Palermo

It is hard to believe that in a span of fifteen months the Toronto and region real estate resale market has gone from record breaking sales and house prices to a precipitous decline, not seen in decades, to a market resurrection in May. Although May did not match the dizzying highs of February and March of 2022, resale results were nothing short of impressive.

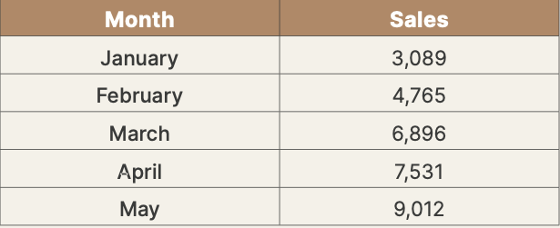

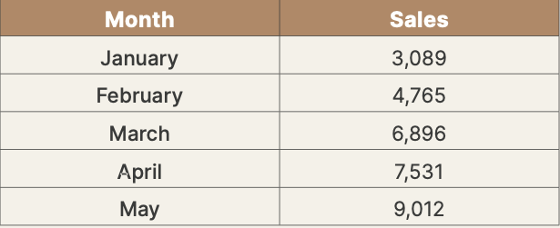

May marked the forth consecutive month of rising sales. What was particularly impressive was the increase in the number of reported sales compared to April. The market reported 9,012 sales in May, a 20 percent increase compared the 7,531 achieved in April, and a 25 percent increase compared to the 7,226 reported sales in May 2022. Whether this accelerated pace can continue into June will depend on a number of factors that will unfold during the course of the months to come.

Clearly the demand for ownership in the greater Toronto region remains strong. Satisfying it continues to be a problem. Government at all levels have simply failed to provide the necessary housing that the region’s high levels of immigration have necessitated. What new housing that has been provided has become even more expensive due to excessive regulatory barriers. A recent C.D. Howe study estimates that in Toronto new homes are $350,000 more expensive due to the regulatory burdens that are choking the housing supply.

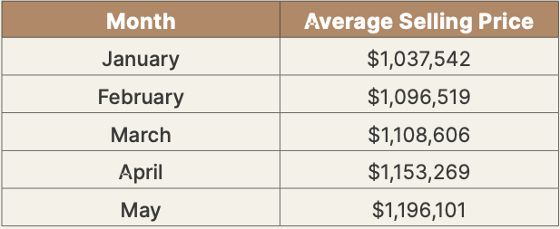

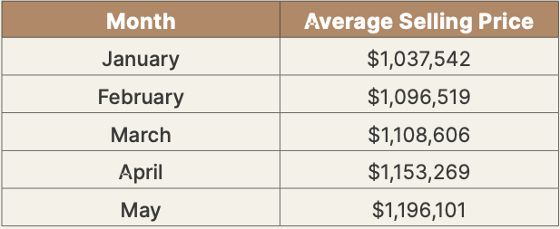

It is no surprise that for the forth connectivity month the average sale price for all properties sold in the Toronto region once again increased, which includes condominium apartments which formed almost 30 percent of the 9,012 reported sales.

The average sale price of condominium apartments was only $748,483 across the region. Detached properties came in at $1,556,566 (but $1,913,132 in the City of Toronto) and the average sale price of semi-detached properties was $1,198,185 (and $1,398,821 in the City of Toronto). What these numbers demonstrate is that the exodus to regions outside the City of Toronto that took place during the pandemic appears to have reversed. During the pandemic demand in the 905 region caused average sale prices in the region to rival Toronto prices. Since January prices throughout the combined City of Toronto-416 region have increased by more than 15 percent.

Demand and supply are having a major impact on average sale prices. In May 15,194 new properties came to market. This was almost 20 percent fewer properties than came to market last May (18,687). As a result of the fewer properties coming to market and the high number of sales that were achieved in May, beginning in June there were merely 11,868 properties available to buyers, substantially lower than the 10 year average for available listings for the month of May.

Given the shortage of available properties on the market it is not surprising that months of inventory for the region has dropped to 2.2 months and that all sales (on average) took place at 105 percent of their asking price. And these sales took place in only 14 days! Even though the average sale price of detached properties came in at almost $2,000,000 in the City of Toronto, all sales took place in 13 days and at 105 percent of their asking price. Semi- detached properties, which had an average sale price of almost $1,400,000, all sold in a mere 11 days and at 111 percent of their asking price. Semi-detached properties in Toronto’s eastern districts all sold in an eye-popping 7 days and at an astounding 118 percent of their asking price. These are truly incredible market statistics and speak to a market very reminiscent to that at the height of the pandemic market, a phenomenon that only a few months ago we thought would be a historical phenomenon never to be repeated.

The supply issue is of particular concern in Toronto’s detached and semi-detached property sectors. At the end of May there were 1,286 active detached listings in Toronto. In May 970 detached properties were reported sold. At the end of May there were only 261 active semi-detached listings in the City of

Toronto, fewer than the 285 that sold in May. These numbers point to a crisis in supply.

Early June results are indicating that the resale market may be plateauing. This is due to three factors. The lack of supply, particularly in the detached and semi-detached housing sector, the average sale price hovering at $1,200,000, and high mortgage interest rates coupled with the added stress test, combined are making buying a home in the City of Toronto and the surrounding region prohibitive. The threat of a potential benchmark rate hike by the Bank of Canada is also causing apprehension amongst buyers. June’s results will be telling as to the direction of the residential resale market for the second half of 2023.

Posted on

June 20, 2023

by

Eugene Palermo

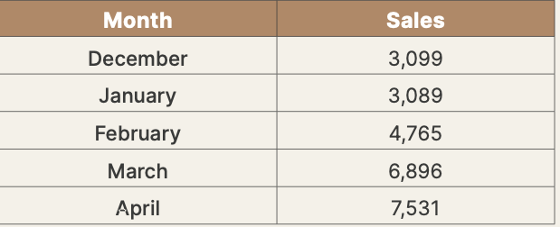

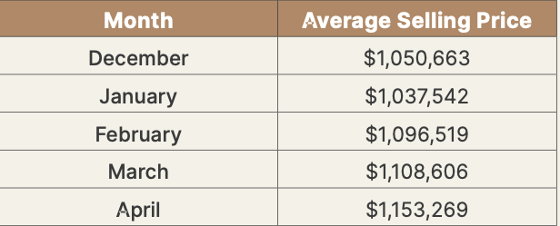

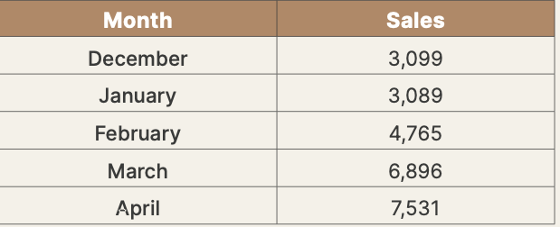

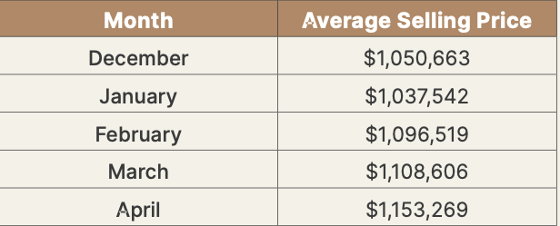

As forecast in March’s Market Report, April’s residential resale market continued its upward trajectory for the third month in a row. Sales volumes increased by more than 9 percent compared to March and the average sale price, which also bounced for the third month in a row since January, increased by more than 3 percent compared to March.

This trajectory is unlikely to change in May. It would have been even steeper if not constrained by affordability and the alarming decline in supply.

Although April’s 7,531 residential sales were 5.2 percent less than the 7,940 sales achieved last year, they reflect growing buyer confidence and acceptance that the exceptionally low financing costs enjoyed during the pandemic are a thing of the past. Demand has not abated, pushed to extraordinarily high levels by growth in population in the greater Toronto region, driven years of high levels of immigration. Between the years 2018 and 2022, more than 600,000 immigrants have moved into southern Ontario. New housing supply has not kept pace with this growth in population.

As a result of the eye-popping demand, average sale prices continue to rise in April, even in the face of high mortgage financing costs and borrower stress testing which adds 2 percent to the interest rate at which borrowers are attempting to qualify. April’s average sale price of $1,153,269 was only 7.8 percent lower than the average sale price achieved in April 2022. When interest rates begin to decline, which is expected in 2024, we could see average sale prices increasing to the stratospheric heights achieved during the pandemic. Six months ago this possibility was inconceivable.

The number of new properties coming to market became even more troubling during April. In April only 11,364 new listings became available to the many buyers waiting to buy. This is a 38 percent decline compared to the 18,416 properties that came to market last April. More troubling is the available supply as April came to an end. At the end of April, there were only 10,373 active listings, more than 20 percent less than the 13,092 properties available to buyers at the end of April last year. April marked the first month since March of last year when active listings were fewer than the corresponding month the year before.

Given the demand and the lack of supply in the greater Toronto area, it is not surprising that all available properties (on average) sold in only 17 days. The speed at which properties sold in April is quickly approaching the speed with which properties in the greater Toronto area sold during the height of the pandemic market – 8 days! All properties in the City of Toronto sold in only 18 days (slightly slower due to the preponderance of condominium apartment sales) but incredibly for 103 percent of their asking prices. In Toronto’s eastern districts all properties, condominium apartments, detached and semi-detached properties sold in only 11 days and for an eye-popping 109 percent of their asking prices. Semi-detached properties in the eastern districts sold in only 8 days at 115 percent of their asking prices. The average sale price of semi-detached properties in Toronto’s eastern districts was $1,223,687. Across all of Toronto the average sale price for semi-detached was $1,326,462. Detached properties came in at $1,787,752

Shockingly there were seven eastern districts that reported less than five semi-detached property sales – simply because there was no supply!

Fast sales and sale prices exceeding asking prices were not restricted to the City of Toronto. All property sales in Halton, York, and Durham region sold well above their asking prices, 101, 105, and 107 percent above asking, respectively, with all properties selling (on average) after only 15 days on the market.

The Toronto and region residential resale market is quickly moving towards crisis levels. Governments now have no one to blame but themselves, and hopefully are beginning to accept that the housing crisis can not be improved by restrictive legislation. At the federal level, there is a prohibition on foreign buyers purchasing residential properties in Canada. At the provincial level, there is a 25 percent (of the purchase price) tax on foreign buyers. At the municipal level (City of Toronto) there is a 1 percent vacancy tax. None of these legislative actions have addressed Toronto and the region’s housing issues. Toronto’s resale market is driven by domestic demand, as numerous studies have demonstrated. Population growth, which is expected to continue, requires appropriate levels of new housing, which have not been forthcoming. It is safe to forecast that the residential resale conditions that have clearly manifested themselves in April will continue and intensify as we move towards the second half of 2023.

This website may only be used by consumers that have a bona fide interest in the purchase, sale, or lease of real estate of the type being offered via the website.

The data relating to real estate on this website comes in part from the MLS® Reciprocity program of the PropTx MLS®. The data is deemed reliable but is not guaranteed to be accurate.